Like most insurance firms, the call center at HNB Assurance has a lot of questions. Sometimes, the same questions are asked often, such as “What is My Pension?”. We had a chat with our call center team/head of call center dept and have compiled your Frequently Asked Questions and decided to answer them for your convenience.

Updated: March 30th, 2015

Q: What’s your hotline/contact number for HNB Assurance & HNB General Insurance?

A: Since the Insurance industry split from Jan 1st 2015, all our Life Insurance solutions are under HNB Assurance. You can call the number for HNB Assurance, which is 0114-384-384 for all your life insurance needs. On the other hand, call the HNB General Insurance number on 0114-883-883 for Motor insurance, Home Insurance, Travel insurance and business insurance solutions.

Q: What should I do in case my vehicle meets with a motor accident?

A: Just dial our 24 hour hotline for HNB General Insurance on 0114-883-883 to report your accident to one of our customer service representatives. They will take your information and reassure you while an assessment officer arrives to inspect your damaged vehicle. After inspection, you will need to produce a repairer estimate (from your vehicle repairer) to go to the next step of your claim.

Q: OK, I’ve got a Repairer Estimate, what do I do now?

A: Simply forward your repair estimate via e-mail, fax or hand it to your closest HNB General Insurance branch or our Motor Claims Department located at 51A, Dharmapala Mawatha Colombo 03 and we’ll take it from there.

Q: How do I report damage caused to my home, if I have a Home Insurance Policy with HNB General Insurance?

A: Call our hotline on 011 – 4 883-883 to report your loss. One of our team members will be there to help. Once you have provided your details of damages caused to your home, our representative will document this information and send an assessment officer to meet you and inspect the damages caused.

Q: I want to get a Motor Insurance Quotation, but I don’t have the time, can you help me?

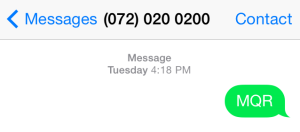

A: Gone are the days when you had to run around and wait for insurance quotes. The HNB General Insurance ‘Motor Guard’ series gives you the convenience of getting the best vehicle insurance rates instantly by sending a SMS to your mobile phone. Simply Text MQR to 0720 200-200. Here are in depth-instructions in case you get stuck.

Got a question for us? Ask away in the comments section!

Disclaimer: The views shared in this blog are based on the macro economic conditions & industry status quo as per the time of publishing.